Starting a Bitcoin ATM Business

We introduced Bitcoin ATMs, aka cryptomats, in early 2013 as a quick and easy solution to the "how do I get Bitcoin?" question.

We introduced Bitcoin ATMs, aka cryptomats, in early 2013 as a quick and easy solution to the "how do I get Bitcoin?" question.

This is because this solution is not only still relevant, but more so than ever, Bitcoin ATMs are more decentralised than online exchanges and do not have custody of user's funds.

You can think of the Bitcoin ATM model as micro-exchanges or automated OTC (over-the-counter) kiosks. The barriers to entry are considerably lower than either and depending on where you want to launch, the regulatory regime could be simpler.

Bitcoin ATMs generate a recurring source of income through a stream of regular customers, while providing the easiest onramp for first-time cryptocurrency buyers. Crypto miners may also consider ATMs as direct way to convert their mined coins to fiat to pay for their operations.

Traditional ATM operators will find a familiar opportunity, but with more upside. An exciting new market that is far from saturation.

The average monthly transaction volume for one-way machines is $350,000, with the typical commission at around 10% - 15%. For an operator’s first machine, the usual ROI has been between 1-2 months. With our more affordable Gaia model, the time to ROI can be much reduced.

Once you have the basics down and your business in place, operating a fleet of machines makes much more sense than operating one.

Our Bitcoin ATMs support several cryptocurrencies other than Bitcoin. You may configure our machines to offer buying and selling of Ethereum, Bitcoin Cash, Litecoin, Zcash and Dash.

You'll need to pay for power, an internet connection, any rent for the space in which the Bitcoin ATM is hosted, and for a server to host the decentralised admin ($20/mo). Our SLA for support is optional, though necessary for ongoing support after the first 30 days.

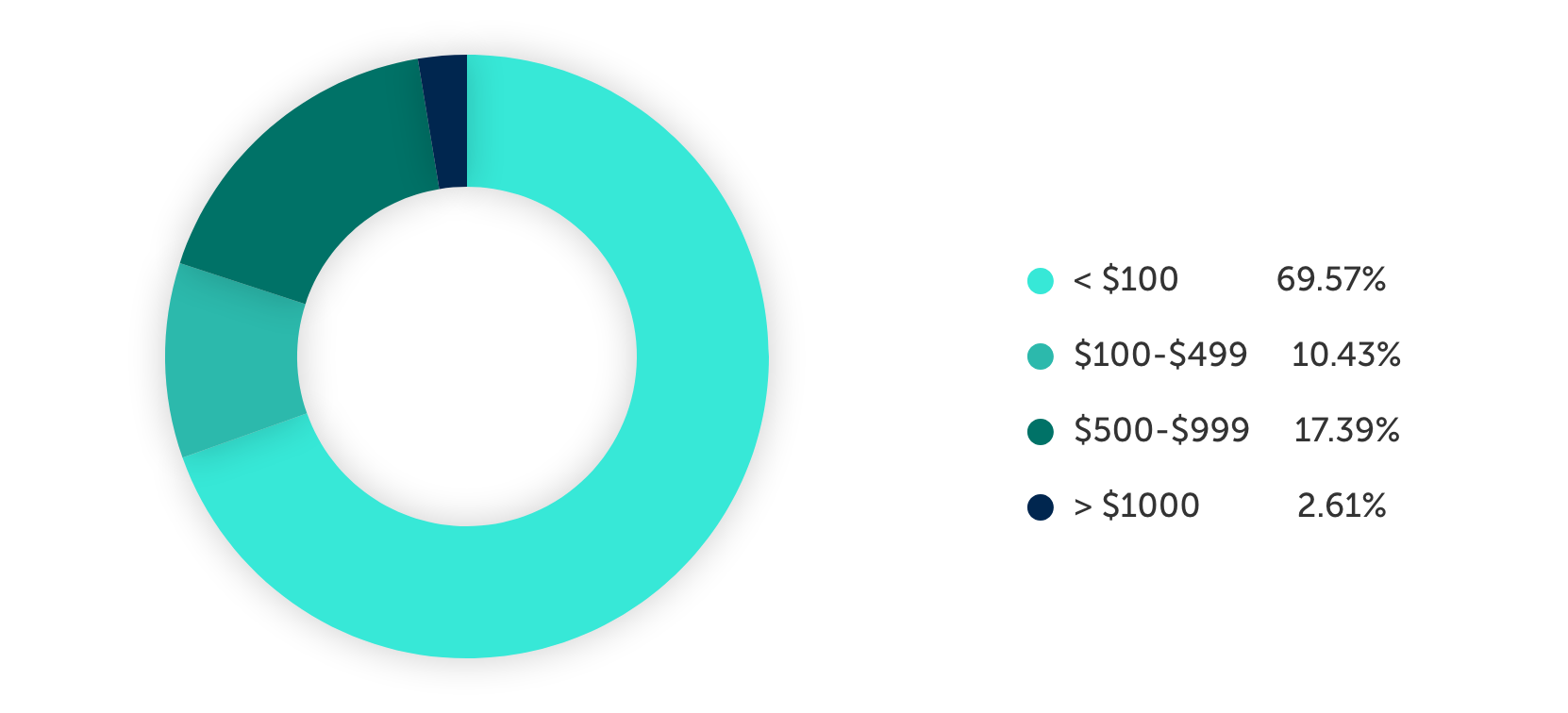

About three-quarters of Bitcoin ATM transactions are under $100, with the average around $250. The typical user is a casual yet repeat customer who regularly puts a bit of their cash into cryptocurrency. It’s as easy as it gets for low amounts and safer than in-person LocalBitcoins buys. Since it’s quicker than setting up an exchange account, and requires no bank transfers, Bitcoin ATMs often serve the underbanked.

Regular visits to the machine will be needed to collect cash, restock cash-out cassettes, cleaning the bill paths, and ensuring a consistent internet connection. You’ll need to keep your crypto wallets and exchange accounts topped up as well.

Unfulfilled compliance obligations in your jurisdiction may halt your operation. Before deploying a Bitcoin ATM, understand what regulations exist in your jurisdiction. Finding bitcoin-friendly banking has also posed a challenge for some, and it helps to have an already well-established banking relationship.

And of course, locations. Once up and running, the locations of your machines will be key to your success. Our backend Admin will help you compare your machine locations and see which work best for you, and which need new locations.

A number of resources can be found from the industry tracker Coin ATM Radar, specifically their ‘ How to Start a Bitcoin ATM Business Knowledge Base ’ and their ROI profitability calculator.

There are no shortage of articles that discuss the business of running a Bitcoin ATM, although we find the most convincing way is to use one yourself and experience a Bitcoin machine as an end-user.

Drop us a line! We’ll be glad to chat and answer any further questions you may have.

After ordering, you’ll want to ensure you have everything in place for your business to operate, such as a bank account, exchange accounts, initial floats of bitcoin, as well as branding to help you market your operation to your customers.